Who we are

Surpassing HR Solution was founded to help professionals create and deliver their brands, much like marketing and public relations professionals do for businesses. From our perspective, you are the business, and we want to help improve your strategy and give you tools that will increase your earning potential.

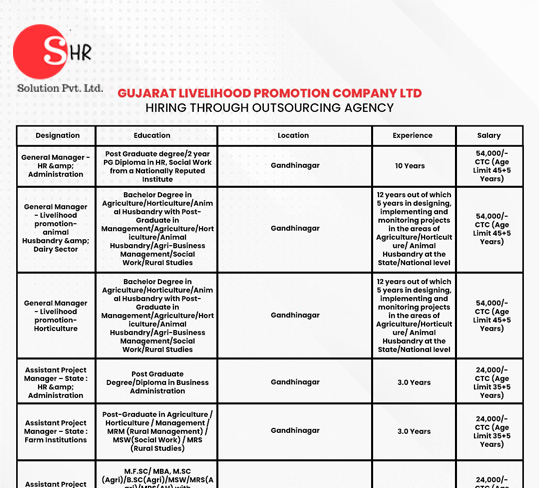

Surpassing HR Solution is a staffing company that provides a range of Temporary and Permanent manpower solutions. Established in 2018, we are emerging as one of the leading HR services providers in India, offering corporate customers an end-to-end solution for all their staffing and HR requirements.

Surpassing HR Solution is aligning in Industry-specific practices and provides HR services to multiple domains, such as Telecom, Sales, FMCG, Consumer Goods, Courier and Logistics, E-commerce, Retail, IT, Skill & Unskilled, and many other industries.

"Unlock the full potential of your business with our tailored services: offshore recruitment support to access top global talent, virtual staffing for enhanced efficiency, strategic BPO solutions, and dynamic digital marketing to elevate your brand. Harness the power of innovation as we help you turn business challenges into growth opportunities. No matter where you operate, “Surpassing HR “optimizes operations, streamlines workflows, and secures a competitive edge. Trust us to expertly manage your business processes and virtual staffing needs, driving success at every turn."

We work with the policy of One client on a One Co-Ordinator basis and Our philosophy is quite simple: your success is our success

.png)

.png)

.png)

.jpg)